So, you’ve found yourself in a fender-bender, huh? Well, fear not, my friend, because I’ve got some tips to help you squeeze every last penny out of that injury settlement after your little rendezvous with another vehicle. Trust me, I’ve seen my fair share of insurance battles, and I’m here to make sure you come out on top.

Key Steps to Maximize Your Injury Settlement After a Vehicle Accident

So, you’ve found yourself in a fender-bender, huh? Buckle up (no pun intended); I’ve got the inside scoop on how to milk that injury settlement for all it’s worth. Let’s dive right in!

Seek Immediate Medical Attention

Well, well, well, look who’s banged up! Don’t be a tough cookie; get yourself checked out by a doc ASAP. Remember, it’s not just about your health; those medical records are golden nuggets for your settlement negotiations. So, hop to it and get those aches and pains documented like your life depends on it (spoiler alert: your settlement amount does)!

Preserve and Gather Evidence

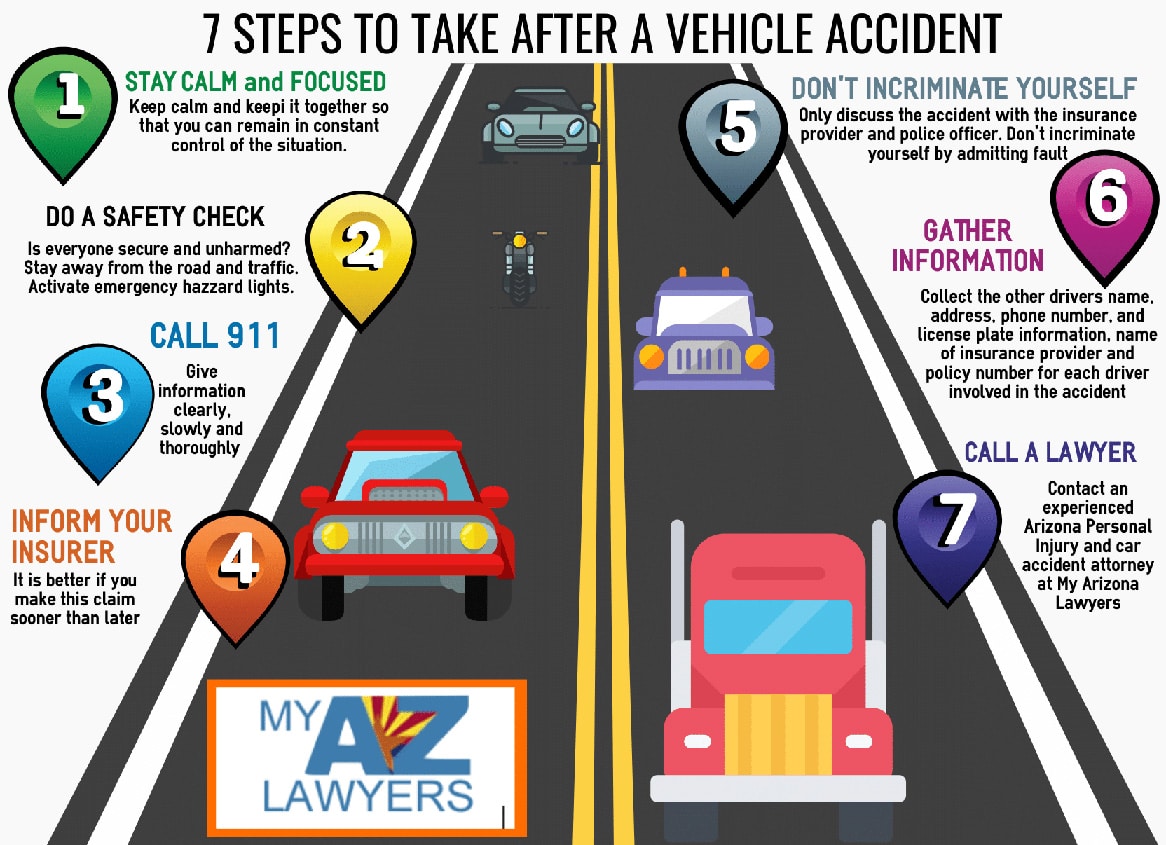

Hey there, Sherlock! Time to put on your investigation hat and gather every piece of evidence like your favorite detective on a mission. Snap photos of the accident scene, jot down witness contacts, grab that police report (if there is one), and hold onto every receipt like they’re winning lotto tickets. The more evidence, the merrier your settlement will be. Trust me; you want that insurance adjuster to see you mean business!

Understand the Full Scope of Your Damages

Oh, it’s damage assessment time! Channel your inner accountant and tally up every single expense, from medical bills to lost wages and even that fancy cab you took when your car was out of commission. Every penny counts, my friend! The more you know about the full extent of your damages, the stronger your negotiation game will be. So, gather those receipts, whip out that calculator, and show ’em what you’re made of!

Legal Strategies to Enhance Your Settlement

As someone who’s been through a fender-bender myself, I know how important it is to maximize your injury settlement. Let’s jump into some legal strategies that can help boost your settlement after a vehicle accident.

Work With an Experienced Personal Injury Attorney

When tackling your settlement negotiations, having an experienced personal injury attorney by your side is like having a superhero in your corner – they know all the tricks of the trade! An attorney can help navigate the complex legal waters, assess the value of your claim, and negotiate with insurance companies to ensure you get the compensation you deserve.

Avoid Common Pitfalls When Dealing With Insurance Companies

Dealing with insurance companies can feel like exploring a maze blindfolded – it’s confusing, frustrating, and downright tricky. Avoid common pitfalls like accepting the first settlement offer (it’s usually low-ball), signing any documents without understanding them fully, or providing recorded statements that could be used against you later. Stay vigilant, and don’t let the insurance company give you the runaround!

Consider the Timing of Your Settlement Negotiations

Timing is key when it comes to settlement negotiations. While you may want to resolve things quickly, rushing into a settlement without fully understanding the extent of your injuries or damages could leave you shortchanged. Take the time to gather all necessary evidence, medical records, and expert opinions before entering into negotiations. Patience can pay off in the long run!

Exploring the legal world after a vehicle accident can be overwhelming, but with the right strategies in place, you can enhance your chances of securing a favorable settlement. Remember, it’s not just about getting compensated for your injuries; it’s about ensuring justice is served.

Negotiating Your Settlement

Negotiating your injury settlement after a vehicle accident can feel like juggling flaming torches – tricky, but not impossible. Let’s jump into the nitty-gritty of maximizing that settlement without breaking a sweat!

Understand the Initial Offer Versus Your Claim’s Worth

So, picture this: you receive an initial offer from the insurance company that’s as satisfying as a deflated balloon animal at a party. Don’t let that deflate your spirits! It’s crucial to know the true value of your claim. Get familiar with your medical expenses, lost wages, and other damages. Don’t settle for less; aim for that shiny pot of gold at the end of the legal rainbow!

Articulate Why an Offer May Be Inadequate

When faced with a lackluster offer, don’t just shrug and settle. Make your voice heard louder than a howler monkey at a concert! Explain why that offer doesn’t cut the mustard. Highlight any additional losses, ongoing medical treatments, or pain and suffering you’re enduring. Paint a vivid picture for the insurance team – not with watercolors but with hard facts!

Negotiate for Future Damages and Non-Economic Losses

Thinking ahead is key, folks! Don’t just focus on the present; consider the future consequences of your injuries. Factor in future medical expenses, rehabilitation costs, and any emotional distress you’re experiencing. Non-economic losses like pain, suffering, and the inability to enjoy life should also be part of the negotiation dance. Show them you mean business – the serious kind of business, not the “bring your cat to the office” kind.

Conclusion

Well, folks, there you have it! Remember, when it comes to maximizing your injury settlement after a car accident, it’s all about playing your cards right. From seeking immediate medical attention to outsmarting those insurance folks, every move counts. Working with a savvy personal injury attorney can be your secret weapon in this settlement game. So, don’t settle for less than you deserve! Negotiate like a pro, know your worth, and watch those damages add up. Stay sharp, stay informed, and most importantly, stay determined to get that settlement you rightfully deserve. Drive safe out there, and may your settlements be as big as your car repair bills!

Frequently Asked Questions

How to maximize pain and suffering?

To maximize pain and suffering in a settlement, document all injuries carefully and seek medical attention immediately after the accident. Keep records of all medical treatments, therapies, and any impact on your daily life as a result of the injuries.

What reduces the amount paid in a claims settlement?

Contributory Negligence can reduce the amount paid in a claim settlement. Insurers might try to shift blame onto you to lower their payout. Threatening Litigation is another tactic used by some insurers to pressure claimants into accepting lower settlements.

How to negotiate for more from insurance settlement?

Negotiate for more in an insurance settlement by understanding the value of your claim, providing strong evidence of damages, and being willing to reject lowball offers. Consider working with a personal injury attorney who can help negotiate a fair settlement on your behalf.

How do insurance companies decide how much to pay out?

Insurance companies determine the settlement amount by establishing legal liability and assessing damages. Damages may include medical bills, car repairs, lost wages, and pain and suffering. The exact amount paid out depends on the specific facts of the case.

How to get the most out of your settlement?

To get the most out of your settlement, gather comprehensive evidence, including medical records, bills, and documentation of other damages. Seek expert legal advice, carefully assess any initial offers, and be prepared to negotiate for a fair and just settlement that covers all your losses.